Registration Process

- Go to the equiti.com website and click the “Start Trading” button.

- Select the country of residence – it must match the payment details address.

- Enter your full name in accordance with the identification document.

- Provide a valid email address to receive important data.

- Create a secure password (at least 8 characters, including special symbols).

- Wait for the email to verify the email and confirm it.

- Provide a mobile phone number and personal data: date of birth, citizenship.

- Review and accept the terms of service.

- Click “Continue” to complete the registration.

At this stage, you also need to go through a short survey that will help Equiti determine your level of knowledge and experience in the financial markets. This is important so that the broker can offer trading conditions and instruments suitable for your profile.

Document Verification

After creating an account, you need to go through the identification procedure:

- Log in to the Equiti client personal account.

- Upload scans/photos of an identity document and a document confirming your address.

- Verification usually takes 1 business day.

The following documents are accepted:

Document | Examples |

Identity Document | Passport, ID card, driver’s license |

Address Confirmation | Utility bill, bank statement, tax notice |

After the documents are approved, you can deposit funds and start trading.

Deposit Methods

- Bank transfer

- Credit/debit cards Visa, MasterCard

- Payment systems Neteller, Skrill, FasaPay, and others

The minimum initial deposit is $500 for Executive, $20,000 for Premiere.

Deposits can also be made using local payment services in different countries where Equiti is present. The current list of available deposit methods can be seen in the personal account.

Trading Account Types

After depositing, you can open one of two account types:

Account Type | Executive | Premiere |

Minimum Deposit | $500 | $20,000 |

Forex Spreads | From 1.6 pips | From 0.2 pips |

Commissions | None | $70 per $1 million turnover |

Instruments | All | All |

Executive is a classic spread account for retail clients.

Premiere is a professional commission account with tight fixed spreads.

The differences between the accounts:

- Premiere offers more favorable spreads and commissions for active traders, but has higher deposit requirements.

- Both accounts allow trading all available instruments without restrictions.

- Clients can choose a convenient base currency for the account: USD, EUR, GBP, AED.

- Islamic swap-free accounts are available for traders adhering to Sharia requirements.

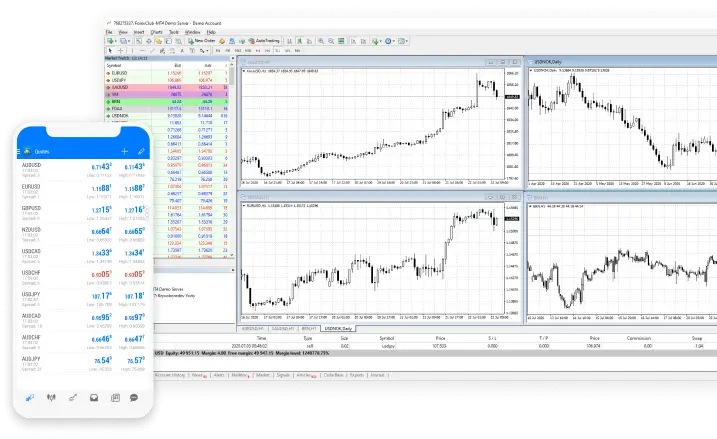

Access to Trading Platforms

After opening a real account, the ability to download and install popular platforms is activated:

- MetaTrader 4

- MetaTrader 5

- Equiti EQ Trader (web terminal)

A mobile trading app for iOS and Android based on MT4 is also available.

Platform functionality:

- Extensive analytical capabilities: technical indicators, drawing tools, news feed

- Work with different order types: market, pending, stop orders

- Automated trading with advisors (EAs)

- Copying trades of experienced traders

- One-click order execution

- Real-time price chart analysis

Services and Education

Equiti provides clients with a number of additional services:

- Analytical portal with research, market reviews, trading ideas

- Economic calendar with expected market events

- Library of educational materials: webinars, video lessons, articles

- PAMM/RAMM managed account programs

- Personal account manager services

Registering with Equiti is the first step towards trading in the global financial markets. Follow the instructions for quickly creating a trader account, verifying, and opening a real trading account with a wide selection of instruments, platforms, and conditions.

FAQ

There are no restrictions, advisors, scalping, and hedging are possible.

The Equiti support service is available by email, phone, and live chat on the official website 24/6.

Yes, Equiti offers a free demo account with virtual funds to test your trading strategies without risk.